| (2 intermediate revisions by one other user not shown) | |||

| Line 9: | Line 9: | ||

Icertis uses a standard framework of discovery, assessment, remediation, monitoring and optimization to manage enterprise risk. | Icertis uses a standard framework of discovery, assessment, remediation, monitoring and optimization to manage enterprise risk. | ||

| − | <div class="image-green-border"> | + | <div class="image-green-border">ICI Risk Management supports the following risk management business scenarios: </div> |

| − | ICI Risk Management supports the following risk management business scenarios: | + | |

| − | + | ||

*'''Business Operations Risk: '''For example, the impact of pandemic on the business operations of an organization. | *'''Business Operations Risk: '''For example, the impact of pandemic on the business operations of an organization. | ||

*'''Contractual Risk:''' For example, managing risks that arise from non-standard agreement terms, clauses, and so on. | *'''Contractual Risk:''' For example, managing risks that arise from non-standard agreement terms, clauses, and so on. | ||

*'''Counter-Party Risk:''' For example, managing risks relevant to suppliers and vendors. | *'''Counter-Party Risk:''' For example, managing risks relevant to suppliers and vendors. | ||

| + | |||

| + | == The Terminology == | ||

| + | |||

| + | Here are some terms that will help you better understand the risk management process: | ||

| + | |||

| + | *Risk Assessment: It deals with the process of identifying and evaluating the magnitude of potential risk areas. | ||

| + | *Risk Area: It is the exposure that an organization has from internal or external factor(s) that impact the normal<br/> functioning of business and will lower its bottom line (or profits) or lead it to fail. For example, cyber security<br/> risk. | ||

| + | **Risk Taxonomy: It is comprehensive set of risk categories and sub-categories used in an<br/> organization. It outlines as approach to categorize and aggregate all types of risks that could affect<br/> the organization's objectives. | ||

| + | **Assessment: Risk owner determines or assesses whether identified risk area is valid or not.<br/> Likewise, risk owner can add a risk area manually. | ||

| + | **Due Diligence: It is a complete review of the risk area. As part of incomplete or missing<br/> information, tasks may be created to gather information. | ||

| + | **Remediation: It is a strategy created to mitigate risks. For example, Avoid strategy, Transfer<br/> Strategy, Reduce Strategy, etc. Based on the remediation strategy, mitigation tasks are initiated. | ||

| + | ***Control Effectiveness Rating: It represents the effectiveness of risk remediation actions<br/> taken to mitigate risk. | ||

| + | *Monitor and Optimize: Monitoring involves the process of tracking the progress of residual risk level and risk<br/> score of a risk area as against the remediation tasks made for mitigation. If the residual risk score and risk<br/> level does not change as compared to the inherent score, then optimization allows taking additional due<br/> diligence or remediation tasks to mitigate risk. | ||

| + | *Risk Score Matrix: It is a matrix that uses a combination of likelihood and consequence rating to determine<br/> magnitude of risk. | ||

| + | **Inherent Risk: It is a risk indicator. It is the starting score for each identified risk area and is<br/> expected to be controlled. | ||

| + | **Residual Risk: It is a risk indicator. It is the score that depicts the risk remaining once mitigation<br/> actions have been planned and implemented. | ||

| + | **Likelihood Rating: On a risk matrix, it represents the likelihood (level of probability) of risk<br/> occurrence. | ||

| + | **Consequence Rating: On a risk matrix, it represents the magnitude (level of impact) of risk<br/> occurrence. | ||

| + | **Risk Level: It is the qualitative score for every risk area transaction. | ||

| + | **Risk Score: It is the quantitative score for every risk area transaction. | ||

| + | |||

| + | | ||

| + | |||

| + | == The Challenge == | ||

| + | |||

| + | Business risk can emerge from any division of a company and must be managed proactively to avoid devastating<br/> impacts. Often, these risks originate in the contracts of an organization with an external party or because of the<br/> business and regulatory environment in which the entity operates.<br/> Yet, most organizations manage contractual, regulatory, financial reporting and environmental obligations<br/> manually. Automated extraction and monitoring of obligations are prevalent in very few companies across various<br/> industry verticals. Consequently, organizations do not have adequate visibility into the status of these obligations<br/> and end up being reactive in identifying and handling risks. | ||

| + | |||

| + | This raises the following challenges: | ||

| + | |||

| + | *Companies cannot proactively assess and manage their risks in business environment characterized by<br/> unpredictability, volatility and mounting counter-party solvency risks. | ||

| + | *Traditional Governance, Risk and Compliance (GRC) and Risk Management tools are not able to roll-up<br/> enterprise-wide risk insights from across contracts which are the ultimate source of commercial truth, and<br/> hence are only good at reporting and analyzing risks in hindsight. | ||

| + | *Lack of visibility and insight into obligations, typically spelled out in detail in service contracts, can lead to<br/> substantial risks for businesses if not surfaced at the appropriate time and monitored at an adequate level to<br/> provide required executive attention. | ||

| + | |||

| + | | ||

| + | |||

| + | == The Solution == | ||

| + | |||

| + | Built on the Icertis Contract Intelligence platform, the ICI Risk Management App brings a paradigm shift in<br/> the management of business risks. The App offers a process-oriented enterprise-wide solution to stay on top<br/> of all potential risks that a business faces – whether they emanate from the potential insolvency of a<br/> counter-party, payment default by a customer, supply disruption due to a pandemic or natural disaster,<br/> logistics blockades due to localized conflicts, or other market turbulence. | ||

| + | |||

| + | With the Risk Management App, companies can: | ||

| + | |||

| + | *Perform risk discovery, assessment, remediation, monitoring and optimization in any business context that is<br/> relevant to a specific organization. For example, supplier risk assessment at the time of onboarding a supplier,<br/> customer credit risk check while signing long-term contracts on non-cash terms, contractual performance risk<br/> while evaluating technical capabilities of a service provider, etc. | ||

| + | *Prevent and reduce risk-injection as opposed to only managing risks. | ||

| + | |||

| + | | ||

| + | |||

| + | == The Capabilities == | ||

| + | |||

| + | The intelligent and easy-to-use ICI Risk Management App offers these powerful capabilities: | ||

| + | |||

| + | *Ability to embed risk assessment in various business processes: | ||

| + | **For example, during negotiation, supplier/ customer onboarding, third party contract ingestion, etc. | ||

| + | *Flexible and configurable risk assessment frameworks: | ||

| + | **To cater to various industry and business-specific risk management requirements. | ||

| + | *Questionnaire-based risk identification: | ||

| + | **Questionnaire configuration capability to discover all vendor or business operation risks based on<br/> responses. | ||

| + | *Risk area and scoring model configurability: | ||

| + | **A configurable risk area to gauge contract, counter-party and operations risk at various levels of<br/> business granularity. | ||

| + | **An easy-to-configure platform that helps to set up a quantitative and qualitative risk score model to<br/> meet business needs. | ||

| + | *Alerts and notifications: | ||

| + | **In-built notifications to inform risk owner about changes in risk area status. | ||

| + | *Auditing: | ||

| + | **Audit trails of every action with user and time-stamp details. | ||

| + | |||

| + | | ||

| + | |||

| + | == The Benefits == | ||

| + | |||

| + | *The ICI Risk Management App changes the risk management paradigm from identification and mitigation to<br/> preventing risk injection and remediation. | ||

| + | *Effective risk monitoring reduces the impact of operational, financial and reputational risk, contributing<br/> significantly to the company’s bottom line. | ||

| + | *Configurable system can conform to any risk model in the world and even develop industry and companyspecific risk models with no custom code required, thereby greatly reducing deployment costs. | ||

| | ||

| Line 24: | Line 93: | ||

*Completed ICI Product Training | *Completed ICI Product Training | ||

*Risk Management App must be enabled on customer environment | *Risk Management App must be enabled on customer environment | ||

| + | |||

| + | | ||

== Configuration setup overview == | == Configuration setup overview == | ||

| Line 124: | Line 195: | ||

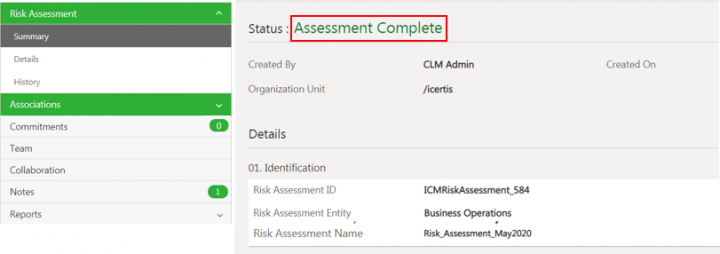

2. '''Click '''the ''View Record ''icon next to the ''Risk Assessment ''record you want to open. For example, ''Risk_Assessment_May2020''. The ''Risk Assessment Details ''page opens. | 2. '''Click '''the ''View Record ''icon next to the ''Risk Assessment ''record you want to open. For example, ''Risk_Assessment_May2020''. The ''Risk Assessment Details ''page opens. | ||

<div class="image-green-border">[[File:7.12-RiskManagement-RiskAssessmentDetails.png|720px|7.12-RiskManagement-RiskAssessmentDetails.png]]</div> <div class="image-green-border"> </div> | <div class="image-green-border">[[File:7.12-RiskManagement-RiskAssessmentDetails.png|720px|7.12-RiskManagement-RiskAssessmentDetails.png]]</div> <div class="image-green-border"> </div> | ||

| − | |||

| − | |||

=== Editing the Risk Assessment === | === Editing the Risk Assessment === | ||

1. '''Click '''Edit on the Risk Assessment Details page. The Edit Agreement page opens. | 1. '''Click '''Edit on the Risk Assessment Details page. The Edit Agreement page opens. | ||

| − | <div class="image-green-border">[[File:7.12-RiskManagement-Edit1.png|720px|7.12-RiskManagement-Edit1.png]]</div> <div class="image-green-border"> </div> <div class="image-green-border">2. '''Make '''the required changes and '''click''' ''Next''. The ''Verify ''page opens. </div> <div class="image-green-border">[[File:7.12-RiskManagement-Edit2.png|720px|7.12-RiskManagement-Edit2.png]]</div> | + | <div class="image-green-border">[[File:7.12-RiskManagement-Edit1.png|720px|7.12-RiskManagement-Edit1.png]]</div> <div class="image-green-border"> </div> <div class="image-green-border">2. '''Make '''the required changes and '''click''' ''Next''. The ''Verify ''page opens. </div> <div class="image-green-border"> </div> <div class="image-green-border">[[File:7.12-RiskManagement-Edit2.png|720px|7.12-RiskManagement-Edit2.png]]</div> |

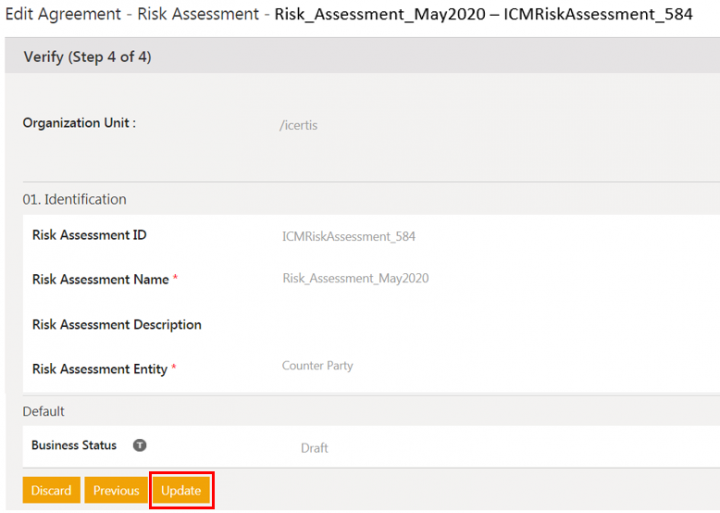

3. '''Verify '''the details and '''click''' ''Update''. The risk assessment is updated and remains in ''Draft'' state. | 3. '''Verify '''the details and '''click''' ''Update''. The risk assessment is updated and remains in ''Draft'' state. | ||

<div class="image-green-border">[[File:7.12-RiskManagement-Edit3.png|720px|7.12-RiskManagement-Edit3.png]]</div> | <div class="image-green-border">[[File:7.12-RiskManagement-Edit3.png|720px|7.12-RiskManagement-Edit3.png]]</div> | ||

| Line 162: | Line 231: | ||

''' Click '''''Submit'' on the Risk Assessment ''Details'' page. The risk assessment is sent for approval and its status changes to ''Waiting for Approva;'' | ''' Click '''''Submit'' on the Risk Assessment ''Details'' page. The risk assessment is sent for approval and its status changes to ''Waiting for Approva;'' | ||

<div class="image-green-border">[[File:7.12-RiskManagement-SubmittingRiskAssessment.png|720px|7.12-RiskManagement-SubmittingRiskAssessment.png]]</div> | <div class="image-green-border">[[File:7.12-RiskManagement-SubmittingRiskAssessment.png|720px|7.12-RiskManagement-SubmittingRiskAssessment.png]]</div> | ||

| − | Approvers can Approve or Reject the Risk Assessment from the risk assessment Details page. | + | Approvers can Approve or Reject the Risk Assessment from the risk assessment Details page. |

| + | |||

| + | | ||

=== Rejecting the risk assessment === | === Rejecting the risk assessment === | ||

| Line 173: | Line 244: | ||

<div class="image-green-border">[[File:7.12-RiskManagement-RejectRiskAssessment1.png|720px|7.12-RiskManagement-RejectRiskAssessment1.png]]</div> | <div class="image-green-border">[[File:7.12-RiskManagement-RejectRiskAssessment1.png|720px|7.12-RiskManagement-RejectRiskAssessment1.png]]</div> | ||

3. '''Click '''Add. The Risk Assessment is rejected and goes back to ''Draft'' state. | 3. '''Click '''Add. The Risk Assessment is rejected and goes back to ''Draft'' state. | ||

| + | |||

| + | | ||

=== Approving the risk assessment === | === Approving the risk assessment === | ||

| Line 196: | Line 269: | ||

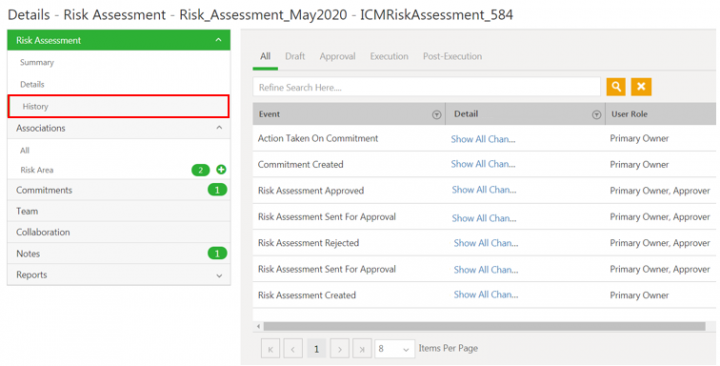

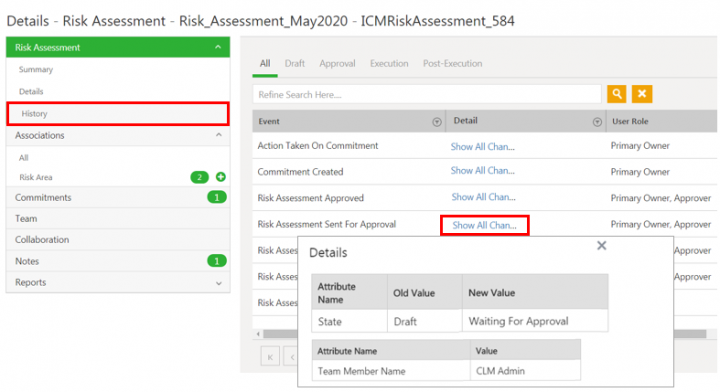

'''Click''' ''Show All Changes'' to view the details of the particular event of the risk assessment instance. | '''Click''' ''Show All Changes'' to view the details of the particular event of the risk assessment instance. | ||

<div class="image-green-border">[[File:7.12-RiskManagement-AuditingRiskAssessment1.png|720px|7.12-RiskManagement-AuditingRiskAssessment1.png]]</div> <div class="image-green-border"> </div> | <div class="image-green-border">[[File:7.12-RiskManagement-AuditingRiskAssessment1.png|720px|7.12-RiskManagement-AuditingRiskAssessment1.png]]</div> <div class="image-green-border"> </div> | ||

| − | |||

| − | |||

== Working with Risk Area == | == Working with Risk Area == | ||

| Line 218: | Line 289: | ||

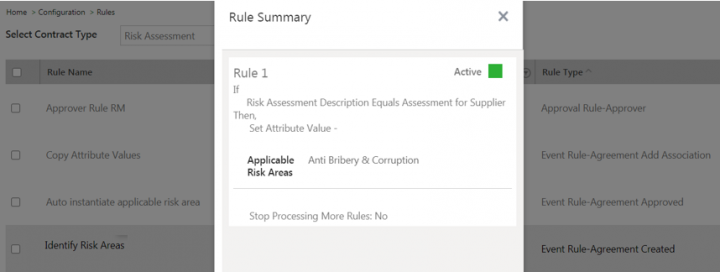

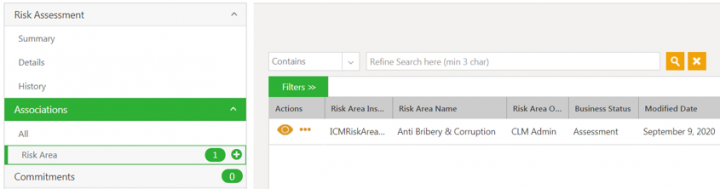

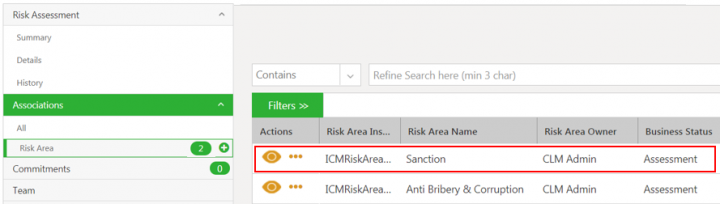

For example, the sample Identify Risk Areas rule with the attribute Risk Assessment Description. When this attribute has the response as Assessment for Supplier, then the Applicable Risk Area is identified and set as Anti Bribery & Corruption. | For example, the sample Identify Risk Areas rule with the attribute Risk Assessment Description. When this attribute has the response as Assessment for Supplier, then the Applicable Risk Area is identified and set as Anti Bribery & Corruption. | ||

<div class="image-green-border">[[File:7.12-RiskAreausingRules.png|720px|7.12-RiskAreausingRules.png]]</div> <div class="image-green-border"> </div> <div class="image-green-border">2. Once the ''Risk Areas'' are identified, the seeded rule Auto instantiate applicable risk area generates those identified risk areas.</div> <div class="image-green-border">3. Another seeded rule Copy attribute values then copies values specified in the rule from Risk Assessment record to the Risk Areas.</div> <div class="image-green-border">For example, when the Risk_Assessment_May2020 is approved, the risk area is automatically created as Anti Bribery & Corruption.</div> <div class="image-green-border"> </div> <div class="image-green-border">[[File:7.12-RiskAreaList.png|720px|7.12-RiskAreaList.png]]</div> | <div class="image-green-border">[[File:7.12-RiskAreausingRules.png|720px|7.12-RiskAreausingRules.png]]</div> <div class="image-green-border"> </div> <div class="image-green-border">2. Once the ''Risk Areas'' are identified, the seeded rule Auto instantiate applicable risk area generates those identified risk areas.</div> <div class="image-green-border">3. Another seeded rule Copy attribute values then copies values specified in the rule from Risk Assessment record to the Risk Areas.</div> <div class="image-green-border">For example, when the Risk_Assessment_May2020 is approved, the risk area is automatically created as Anti Bribery & Corruption.</div> <div class="image-green-border"> </div> <div class="image-green-border">[[File:7.12-RiskAreaList.png|720px|7.12-RiskAreaList.png]]</div> | ||

| + | | ||

| + | |||

=== Creating Risk Area manually === | === Creating Risk Area manually === | ||

| Line 264: | Line 337: | ||

| | ||

<div class="note-box">'''Note''': The certain values in the risk area details section can be auto-populated from Risk Area Master . The Risk Owner and Additional Risk Area Owners can be added to the risk area team through configured rules.</div> | <div class="note-box">'''Note''': The certain values in the risk area details section can be auto-populated from Risk Area Master . The Risk Owner and Additional Risk Area Owners can be added to the risk area team through configured rules.</div> | ||

| − | |||

| − | |||

'''Inherent Risk Rating ''' | '''Inherent Risk Rating ''' | ||

| Line 297: | Line 368: | ||

5. '''Click '''''Create''. The Risk Area is created in Assessment state. | 5. '''Click '''''Create''. The Risk Area is created in Assessment state. | ||

<div class="image-green-border">[[File:7.12-RiskAreaCreatedList.png|720px|7.12-RiskAreaCreatedList.png]]</div> <div class="image-green-border"> </div> | <div class="image-green-border">[[File:7.12-RiskAreaCreatedList.png|720px|7.12-RiskAreaCreatedList.png]]</div> <div class="image-green-border"> </div> | ||

| − | |||

| − | |||

=== Searching Risk Area records === | === Searching Risk Area records === | ||

| Line 366: | Line 435: | ||

Users can edit the risk area from risk area details page as well. | Users can edit the risk area from risk area details page as well. | ||

<div class="image-green-border">[[File:7.12-EditRiskArea1.png|720px|7.12-EditRiskArea1.png]]</div> <div class="image-green-border"> </div> | <div class="image-green-border">[[File:7.12-EditRiskArea1.png|720px|7.12-EditRiskArea1.png]]</div> <div class="image-green-border"> </div> | ||

| − | |||

| − | |||

==== Initiating Due Diligence ==== | ==== Initiating Due Diligence ==== | ||

| Line 378: | Line 445: | ||

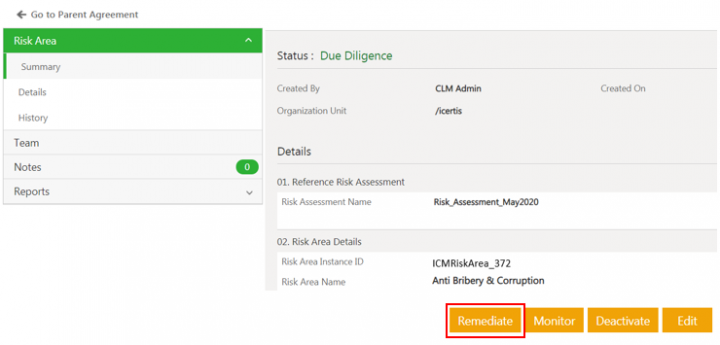

'''Click '''Remediate on the risk area Details page. The Risk Area Details page opens again. | '''Click '''Remediate on the risk area Details page. The Risk Area Details page opens again. | ||

<div class="image-green-border">[[File:7.12-RemediateRiskArea.png|720px|7.12-RemediateRiskArea.png]]</div> | <div class="image-green-border">[[File:7.12-RemediateRiskArea.png|720px|7.12-RemediateRiskArea.png]]</div> | ||

| − | |||

| − | |||

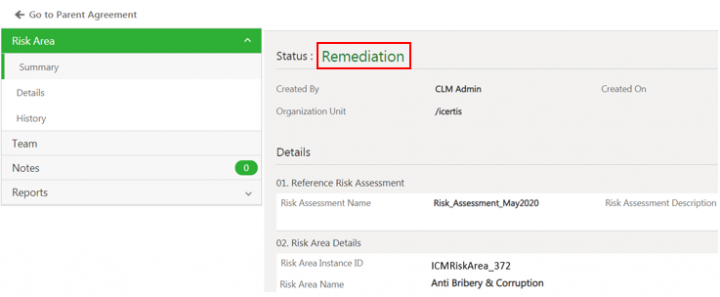

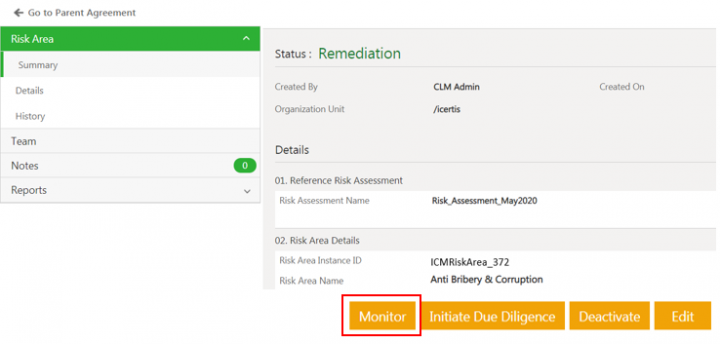

The risk area Details page opens again and the status of the risk area changes to Remediation.. | The risk area Details page opens again and the status of the risk area changes to Remediation.. | ||

<div class="image-green-border">[[File:7.12-RiskAreaRemediation1.png|720px|7.12-RiskAreaRemediation1.png]]</div> | <div class="image-green-border">[[File:7.12-RiskAreaRemediation1.png|720px|7.12-RiskAreaRemediation1.png]]</div> | ||

| Line 491: | Line 556: | ||

| | ||

| − | '''Related Topics''':'' [[Agreement_Management|Agreement | + | '''Related Topics''':'' [[Agreement_Management|Agreement Management]] | [[Biz_Apps_Release_Notes|Biz Apps Release Notes]] | '' |

Latest revision as of 06:16, 22 December 2020

Contents

- 1 ICI Risk Management App

- 1.1 Overview

- 1.2 The Terminology

- 1.3 The Challenge

- 1.4 The Solution

- 1.5 The Capabilities

- 1.6 The Benefits

- 1.7 The Prerequisites

- 1.8 Configuration setup overview

- 1.9 Prerequisite set-up

- 1.10 Working with Risk Assessment

- 1.11 Creating a Risk Assessment

- 1.11.1 Searching and viewing the Risk Assessment

- 1.11.2 Editing the Risk Assessment

- 1.11.3 Canceling the Risk Assessment

- 1.11.4 Deleting the Risk Assessment

- 1.11.5 Submitting the Risk Assessment

- 1.11.6 Rejecting the risk assessment

- 1.11.7 Approving the risk assessment

- 1.11.8 Auditing Risk Assessment

- 1.12 Working with Risk Area

- 1.13 Creating and managing tasks for Risk workflow

- 1.14 Accessing the Risk Area actions Notifications

ICI Risk Management App

Overview

The Icertis Contract Intelligence (ICI) platform introduces the Risk Management Application to make it easier for professionals to carry out their tasks related to risk management such as assessment, due diligence, remediation, monitoring and reassessment. Risk management is the process of identifying potential risk, assessing the magnitude of risk based on the business objectives, devising strategies to eliminate them and tracking the performance until they are completely mitigated.

The platform’s modern, scalable and integration-friendly cloud architecture can model even the most complex risk management scenarios. The App provides secure access such that only authorized users can access the App entities and data, using ICI’s access control functionalities. The user-friendly interface makes it possible for anyone in the enterprise having access to be able to use the platform with ease.

Icertis uses a standard framework of discovery, assessment, remediation, monitoring and optimization to manage enterprise risk.

- Business Operations Risk: For example, the impact of pandemic on the business operations of an organization.

- Contractual Risk: For example, managing risks that arise from non-standard agreement terms, clauses, and so on.

- Counter-Party Risk: For example, managing risks relevant to suppliers and vendors.

The Terminology

Here are some terms that will help you better understand the risk management process:

- Risk Assessment: It deals with the process of identifying and evaluating the magnitude of potential risk areas.

- Risk Area: It is the exposure that an organization has from internal or external factor(s) that impact the normal

functioning of business and will lower its bottom line (or profits) or lead it to fail. For example, cyber security

risk.- Risk Taxonomy: It is comprehensive set of risk categories and sub-categories used in an

organization. It outlines as approach to categorize and aggregate all types of risks that could affect

the organization's objectives. - Assessment: Risk owner determines or assesses whether identified risk area is valid or not.

Likewise, risk owner can add a risk area manually. - Due Diligence: It is a complete review of the risk area. As part of incomplete or missing

information, tasks may be created to gather information. - Remediation: It is a strategy created to mitigate risks. For example, Avoid strategy, Transfer

Strategy, Reduce Strategy, etc. Based on the remediation strategy, mitigation tasks are initiated.- Control Effectiveness Rating: It represents the effectiveness of risk remediation actions

taken to mitigate risk.

- Control Effectiveness Rating: It represents the effectiveness of risk remediation actions

- Risk Taxonomy: It is comprehensive set of risk categories and sub-categories used in an

- Monitor and Optimize: Monitoring involves the process of tracking the progress of residual risk level and risk

score of a risk area as against the remediation tasks made for mitigation. If the residual risk score and risk

level does not change as compared to the inherent score, then optimization allows taking additional due

diligence or remediation tasks to mitigate risk. - Risk Score Matrix: It is a matrix that uses a combination of likelihood and consequence rating to determine

magnitude of risk.- Inherent Risk: It is a risk indicator. It is the starting score for each identified risk area and is

expected to be controlled. - Residual Risk: It is a risk indicator. It is the score that depicts the risk remaining once mitigation

actions have been planned and implemented. - Likelihood Rating: On a risk matrix, it represents the likelihood (level of probability) of risk

occurrence. - Consequence Rating: On a risk matrix, it represents the magnitude (level of impact) of risk

occurrence. - Risk Level: It is the qualitative score for every risk area transaction.

- Risk Score: It is the quantitative score for every risk area transaction.

- Inherent Risk: It is a risk indicator. It is the starting score for each identified risk area and is

The Challenge

Business risk can emerge from any division of a company and must be managed proactively to avoid devastating

impacts. Often, these risks originate in the contracts of an organization with an external party or because of the

business and regulatory environment in which the entity operates.

Yet, most organizations manage contractual, regulatory, financial reporting and environmental obligations

manually. Automated extraction and monitoring of obligations are prevalent in very few companies across various

industry verticals. Consequently, organizations do not have adequate visibility into the status of these obligations

and end up being reactive in identifying and handling risks.

This raises the following challenges:

- Companies cannot proactively assess and manage their risks in business environment characterized by

unpredictability, volatility and mounting counter-party solvency risks. - Traditional Governance, Risk and Compliance (GRC) and Risk Management tools are not able to roll-up

enterprise-wide risk insights from across contracts which are the ultimate source of commercial truth, and

hence are only good at reporting and analyzing risks in hindsight. - Lack of visibility and insight into obligations, typically spelled out in detail in service contracts, can lead to

substantial risks for businesses if not surfaced at the appropriate time and monitored at an adequate level to

provide required executive attention.

The Solution

Built on the Icertis Contract Intelligence platform, the ICI Risk Management App brings a paradigm shift in

the management of business risks. The App offers a process-oriented enterprise-wide solution to stay on top

of all potential risks that a business faces – whether they emanate from the potential insolvency of a

counter-party, payment default by a customer, supply disruption due to a pandemic or natural disaster,

logistics blockades due to localized conflicts, or other market turbulence.

With the Risk Management App, companies can:

- Perform risk discovery, assessment, remediation, monitoring and optimization in any business context that is

relevant to a specific organization. For example, supplier risk assessment at the time of onboarding a supplier,

customer credit risk check while signing long-term contracts on non-cash terms, contractual performance risk

while evaluating technical capabilities of a service provider, etc. - Prevent and reduce risk-injection as opposed to only managing risks.

The Capabilities

The intelligent and easy-to-use ICI Risk Management App offers these powerful capabilities:

- Ability to embed risk assessment in various business processes:

- For example, during negotiation, supplier/ customer onboarding, third party contract ingestion, etc.

- Flexible and configurable risk assessment frameworks:

- To cater to various industry and business-specific risk management requirements.

- Questionnaire-based risk identification:

- Questionnaire configuration capability to discover all vendor or business operation risks based on

responses.

- Questionnaire configuration capability to discover all vendor or business operation risks based on

- Risk area and scoring model configurability:

- A configurable risk area to gauge contract, counter-party and operations risk at various levels of

business granularity. - An easy-to-configure platform that helps to set up a quantitative and qualitative risk score model to

meet business needs.

- A configurable risk area to gauge contract, counter-party and operations risk at various levels of

- Alerts and notifications:

- In-built notifications to inform risk owner about changes in risk area status.

- Auditing:

- Audit trails of every action with user and time-stamp details.

The Benefits

- The ICI Risk Management App changes the risk management paradigm from identification and mitigation to

preventing risk injection and remediation. - Effective risk monitoring reduces the impact of operational, financial and reputational risk, contributing

significantly to the company’s bottom line. - Configurable system can conform to any risk model in the world and even develop industry and companyspecific risk models with no custom code required, thereby greatly reducing deployment costs.

The Prerequisites

The user must have:

- Completed ICI Product Training

- Risk Management App must be enabled on customer environment

Configuration setup overview

ICI offers the ability to determine the application type (Contracting, Sourcing, Obligation Management and Risk Management application) when creating a contract type. This is possible with the inclusion of two new choice type attributes, Business Application Type and Business Application Category at the contract type level. This feature helps effortlessly drive business applications on ICI platform.

These attributes are enabled through technical configuration and applicable for agreements and associated document contract types. The access privileges for business applications (such as Risk Management) are managed through security groups.

Seeded Configuration and setup

The ICI Risk Management application provides some seeded entities, attributes, workflows, rules and notifications that are necessary for the flow of the risk management. Some of the entities are:

- Masterdata:

- Risk Taxonomy

- Risk Remediation

- Risk Area Master

- Likelihood Rating

- Risk Score Matrix

- Contract types:

- Risk Assessment: as agreement contract type with Business Application Type as Risk Management and Business Application Category as Risk Assessment defined at contract type level.Risk Area as associated document contract type with business application type as risk management and business application category as risk area defined at contract type level.

- Risk Area: as associated document contract type with Business Application Type as Risk Management and Business Application Category as Risk Area defined at contract type level.

- Rules:

- Instantiate the risk areas after completing the risk assessment

- Copy attribute values from risk assessment to the risk area

- Add Team members to the risk area

- Notifications for events:

- Risk area is created

- Risk area due diligence is initiated

- Risk area remediation is initiated

- Risk area monitoring is initiated

- Risk area is deactivated

Refer the Risk Management Configuration guide for details.

Prerequisite set-up

The ICI Risk Management application provides some seeded masterdata that are necessary for the flow of the risk management. Users can create masterdata instances with desired values.

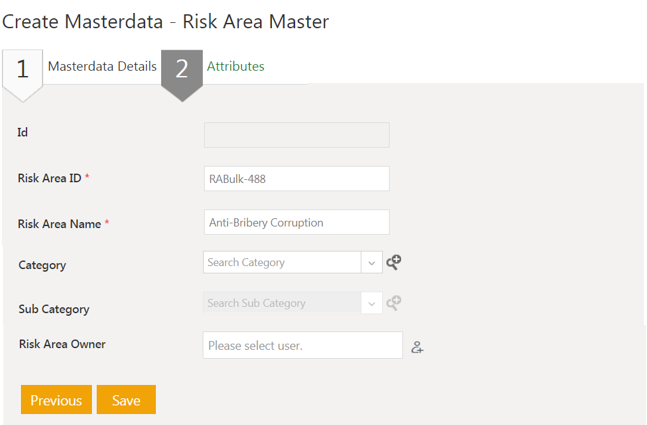

To create masterdata instance:

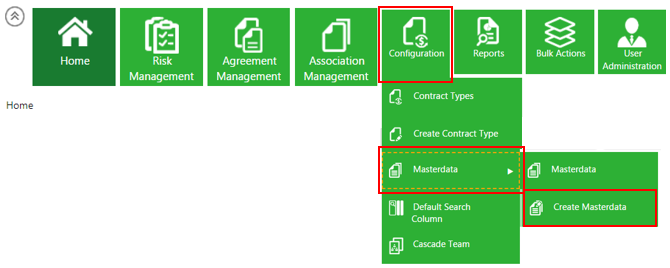

1. Click Configuration > Masterdata > Create Masterdata on the Home page. The Create Masterdata page opens.

2. Select the Masterdata Contract Type. For example, Risk Area Master.

3. Click Next. The Attributes page opens.

4. Enter or select the details in the fields. For example, enter Risk Area Name as Anti-Bribery Corruption.

5. Click Save. The masterdata instance is created.

Similarly, setup masterdata for Risk Taxonomy, Risk Remediation action, Likelihood Rating and Risk Score Matrix Masters.

Working with Risk Assessment

The ICI Risk Management application enables users to manage risks by creating risk assessment. Risk Assessment deals with the process of identifying and evaluating the magnitude of potential risk areas. For example, buyers can use the ICI Risk Management application that allows configuring a questionnaire to perform supplier risk assessment. The risk areas can be identified based on the responses received for the questionnaire as the outcome of the risk assessment process.

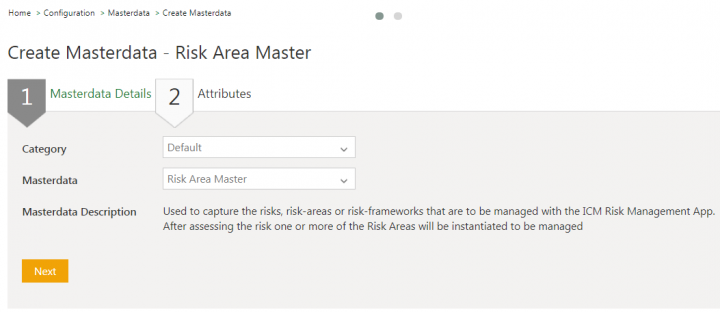

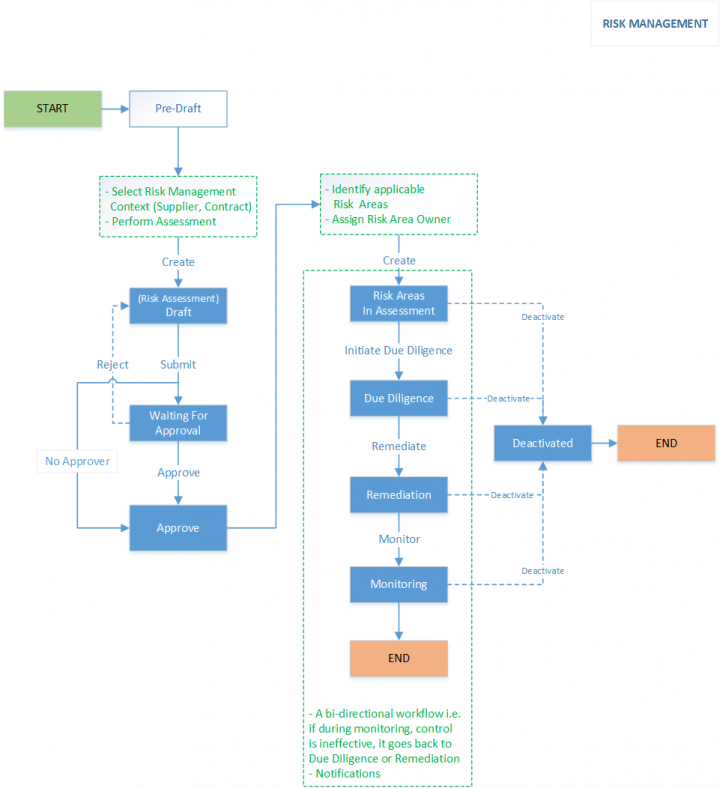

Risk assessment workflow performed by risk assessment owners typically involves the following:

- Initiating Risk Assessment: The risk assessment owners can initiate the risk assessment workflow to identify the risks. For example, the risk assessment can be a questionnaire where the users respond to the questions by submitting it. This initiates the risk assessment in Draft state.

- Approving Risk Assessment: Based on the complexity of risk assessment, ICI administrators can configure the rules to add approvers to the assessment team. If there are approvers added to the team, the risk assessment is sent to the approvers for approval. The risk assessment is approved automatically if no approvers are added to the team.

- Completing Risk Assessment: The status of the risk assessment changes to Assessment Complete when the risk assessment is approved. The risk area can be identified and auto-instantiated based on the configured rules.

Here is the Risk Assessment workflow at a glance:

Creating a Risk Assessment

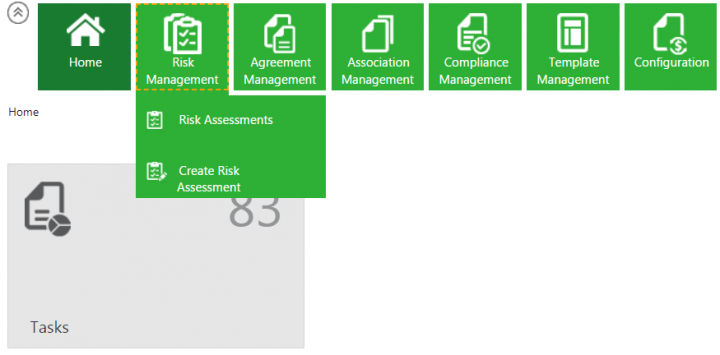

1.Click the Risk Management tile on the Home page. The drop-down opens with options:

- Risk Assessment

- Create Risk Assessment

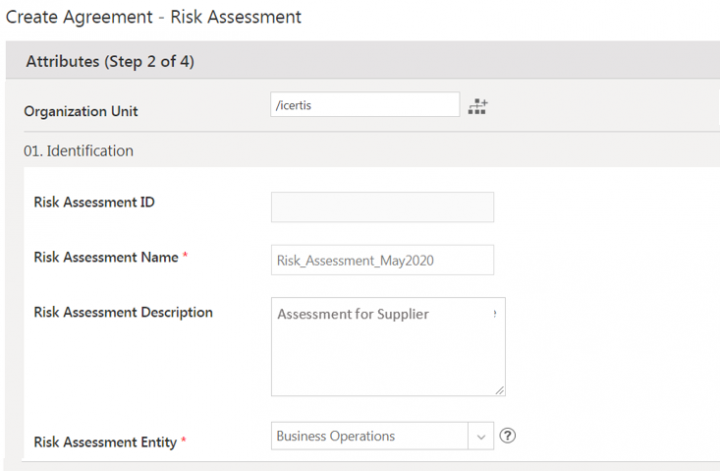

2. Click Create Risk Assessment. The Attributes page for Create Risk Assessment opens. The Attributes page includes questions to capture the responses based on which the risk areas can be generated. These questions are non-seeded attributes and users can configure them to the Risk Assessment contract type as per their business needs.

Attributes page has seeded sections as:

- Identification

- Risk Assessment Timeline

3. Enter the details in fields in the Identification section:

- Risk Assessment Name

- Risk Assessment Description

- Risk Assessment Entity: The context for which the risk assessment is being created. For example, Business Operations, Contractual or Counter Party.

4. Enter the details in fields in the Risk Assessment Timeline section.

- Assessment Start Date: The date that you start the risk assessment of entity. For example, May 31, 2020.

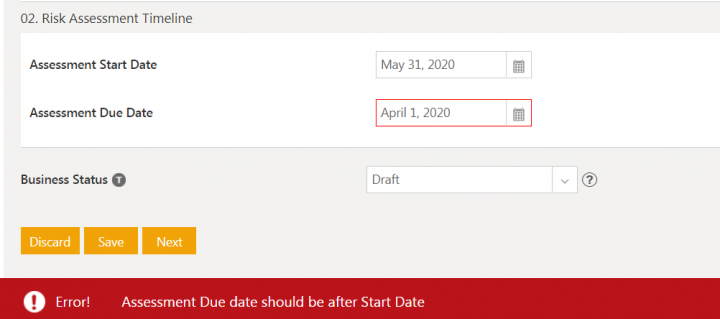

- Assessment End Date: The date by which risk assessment of entity should be completed. The assessment end date should be greater than the start date else validation is displayed.

5. Enter the details in fields in all the sections on the Attributes page.

6. Click Next. The Verify page opens.

7. Verify the details and click Create. The risk assessment is created in Draft state.

Once created, users can Edit, Delete, Cancel or Submit the Risk Assessment.

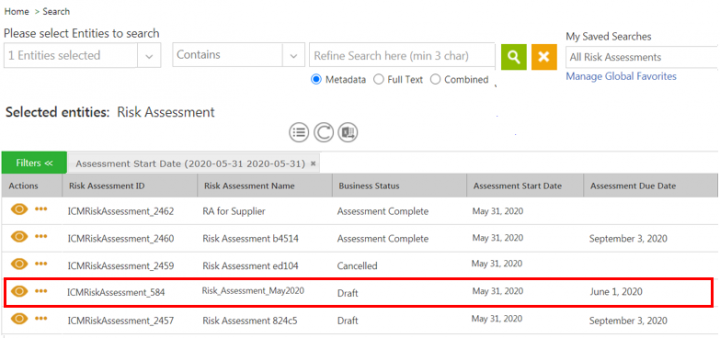

Searching and viewing the Risk Assessment

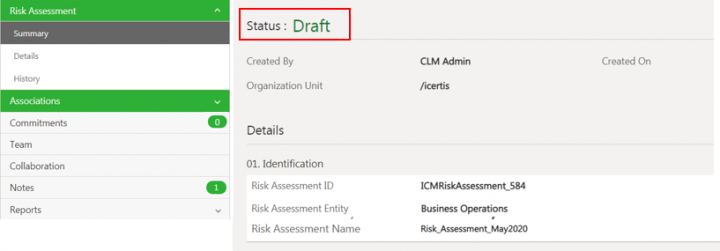

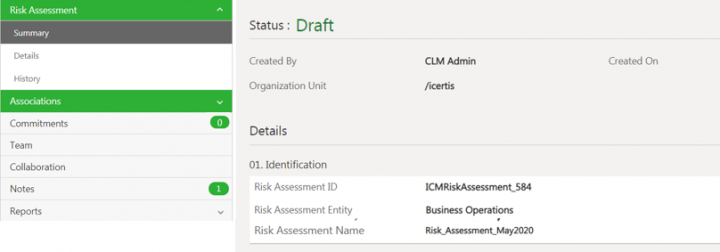

1. Click the Risk Management > Risk Assessment on the Home page.

2. Click the View Record icon next to the Risk Assessment record you want to open. For example, Risk_Assessment_May2020. The Risk Assessment Details page opens.

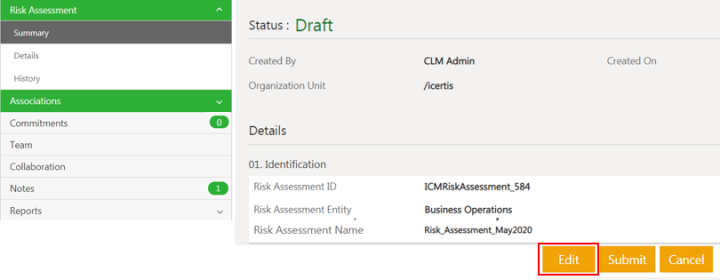

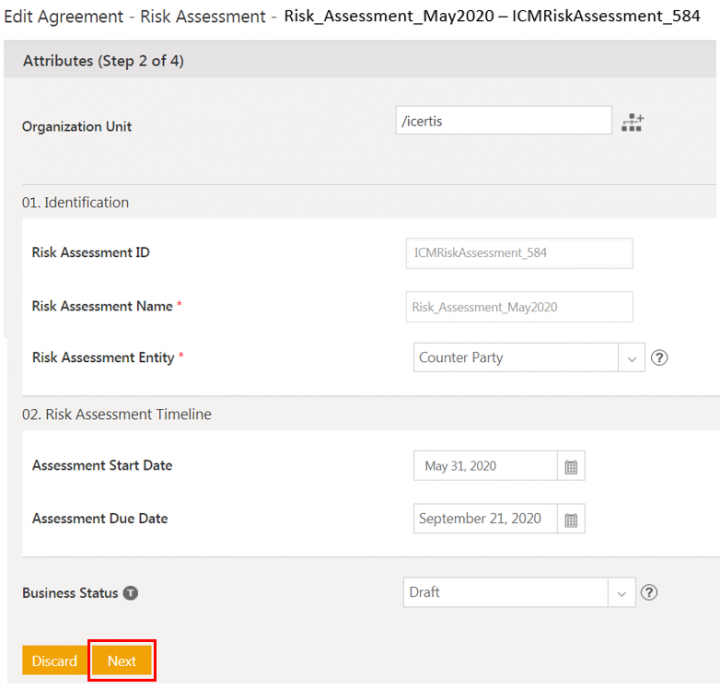

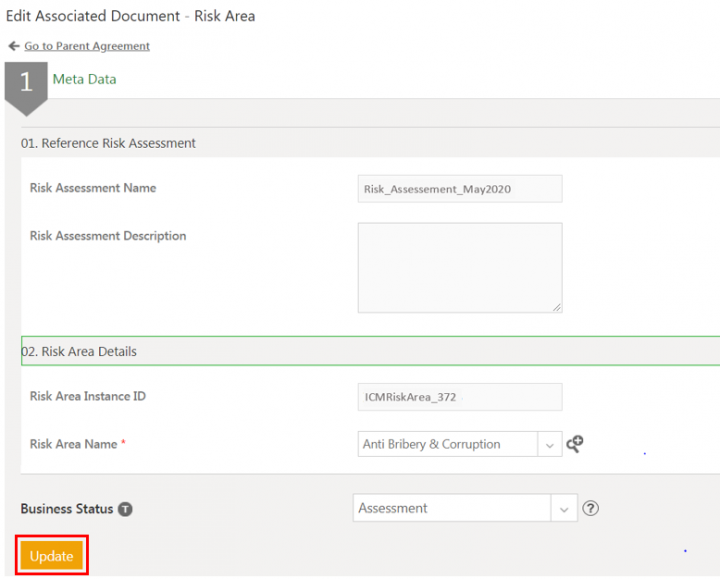

Editing the Risk Assessment

1. Click Edit on the Risk Assessment Details page. The Edit Agreement page opens.

3. Verify the details and click Update. The risk assessment is updated and remains in Draft state.

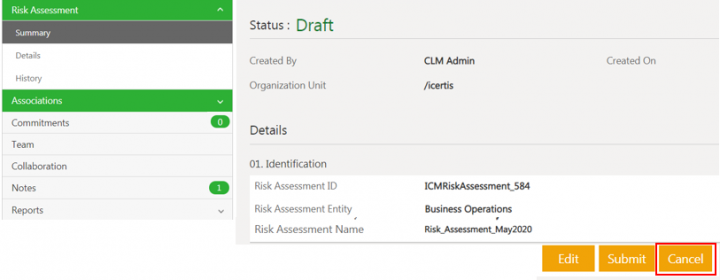

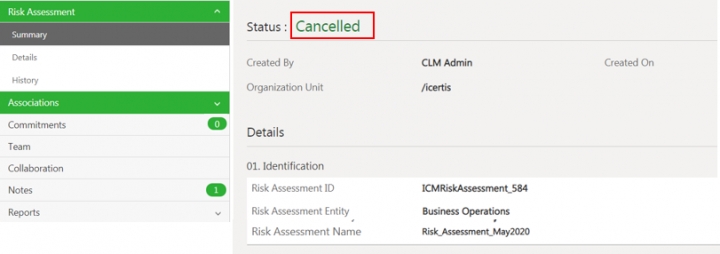

Canceling the Risk Assessment

1.Click Cancel on the Risk Assessment Details page.

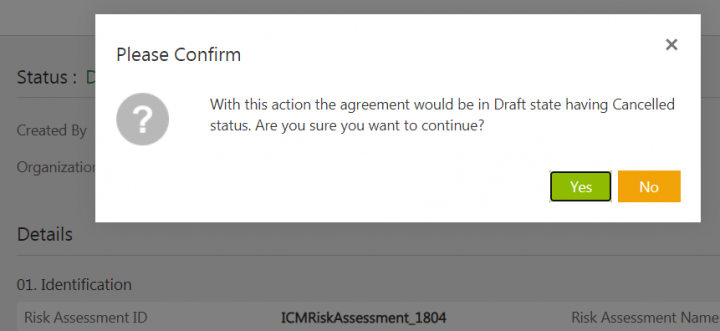

The confirmation window opens.

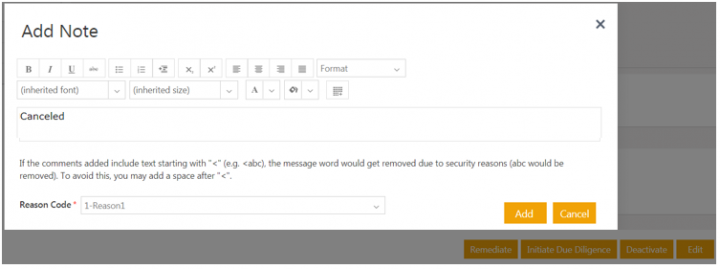

2. Click Yes. The Add Note window opens.

3. Add note text and select the Reason Code.

4. Click Add. The Risk Assessment status changes to Cancelled.

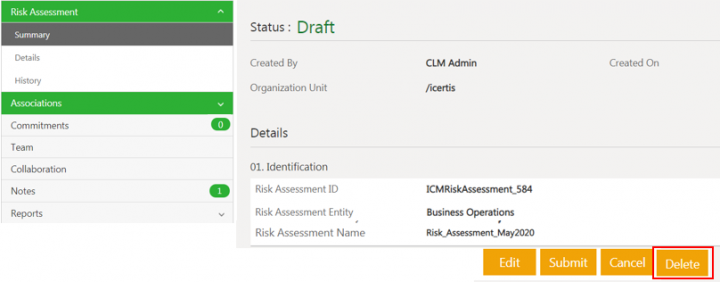

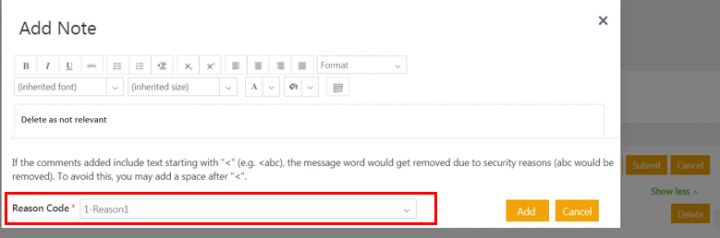

Deleting the Risk Assessment

1. Click Delete on the Risk Assessment Details page.

2. Add note text and select the Reason Code.

3. Click Add. The risk assessment will be deleted and agreement index page opens.

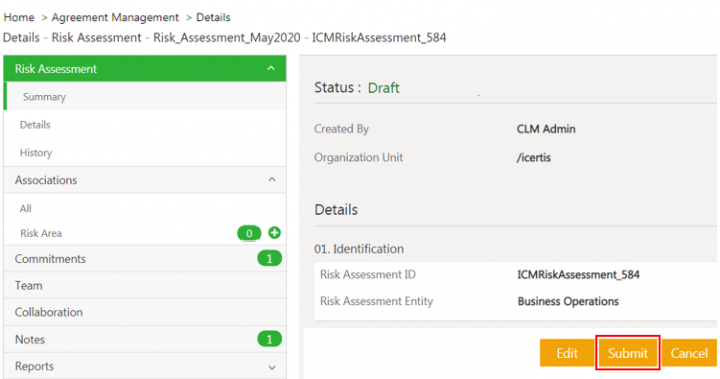

Submitting the Risk Assessment

Click Submit on the Risk Assessment Details page. The risk assessment is sent for approval and its status changes to Waiting for Approva;

Approvers can Approve or Reject the Risk Assessment from the risk assessment Details page.

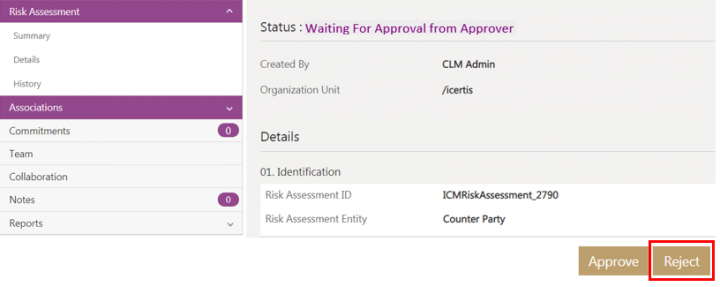

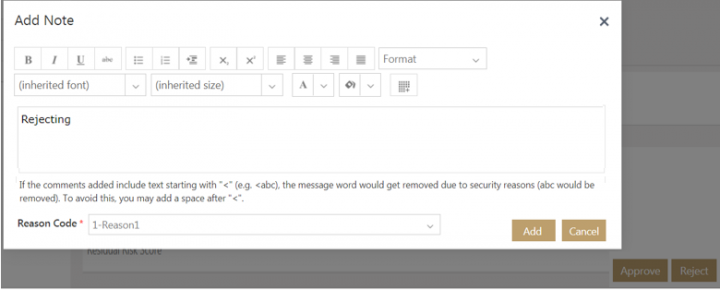

Rejecting the risk assessment

To reject:

1. Click Reject.

2. Add note text and select the Reason Code.

3. Click Add. The Risk Assessment is rejected and goes back to Draft state.

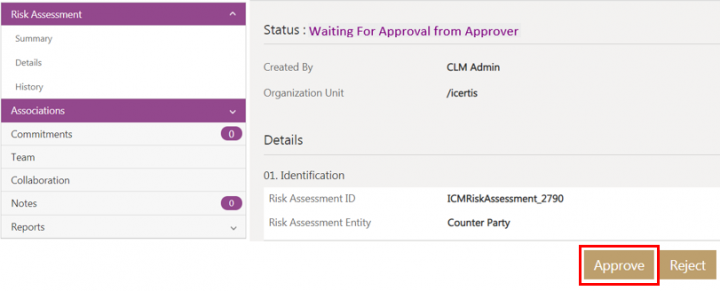

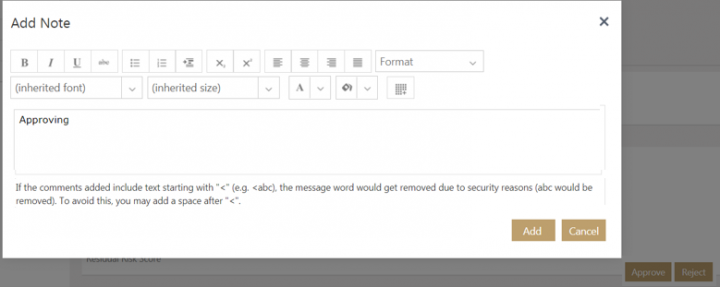

Approving the risk assessment

To approve:

1. Click Approve. The Add Note window opens.

2. Add note text.

3. Click Add. The Risk Assessment state changes to Assessment Complete.

If there are no Approvers added to the Risk Assessment Team, the record will be approved directly and move to the Assessment Complete state.

Auditing Risk Assessment

Changes made to the Risk Assessment record during various ICI risk management workflows are captured and can be viewed under History tab. For example, changes in Risk_Assessment_May2020 throughout its lifecycle are captured.

Click Show All Changes to view the details of the particular event of the risk assessment instance.

Working with Risk Area

Managing Risk Area includes:

- Ensuring the validity of the identified risk area

- Devising strategies to mitigate risks

- Tracking the performance until risks are completely mitigated

The risk area can be generated automatically by seeded rules based on the risk assessment responses. Users can also add the risk area manually to the risk assessment.

Creating Risk Area automatically using rules

The ICI Risk Management application provides set of rules to generate Risk Areas automatically based on the responses gathered from the risk assessment. Refer the ICI Risk Management Configuration Guide for details on rules used in the ICI Risk Management application.

The workflow for generating risk areas automatically includes process as follows:

1. A recommended rule Identify Risk Areas on the event Risk Assessment Created identifies applicable risk areas based on the specific attribute values from the Risk Assessment record.

For example, the sample Identify Risk Areas rule with the attribute Risk Assessment Description. When this attribute has the response as Assessment for Supplier, then the Applicable Risk Area is identified and set as Anti Bribery & Corruption.

Creating Risk Area manually

To create a risk area for risk assessment:

1. Click Risk Management > Risk Assessment on the Home page. The search results page with all risk assessment records opens.

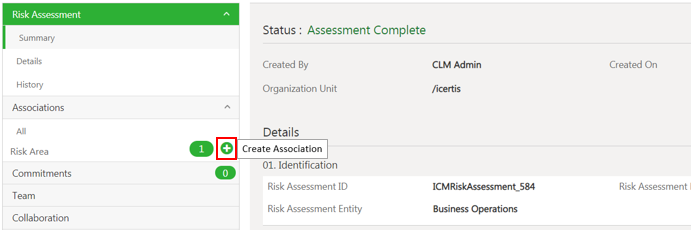

2. Click the View Record icon next to the Risk Assessment for which you want to create Risk Area. The Risk Assessment Details page opens.

3. Click Create Association action icon (plus sign) next to Risk Area under the Associations. The Create Association for Risk Area page opens.

The Create Association Risk Area page has sections:

- Reference Risk Assessment

- Risk Area Details

- Inherent Risk Rating

- Risk Remediation Plan

- Residual Risk Rating

4. Select or enter the details in the attributes in all the sections. The attributes can be mandatory, lookup type, cascading, conditional, multi-select and so on.

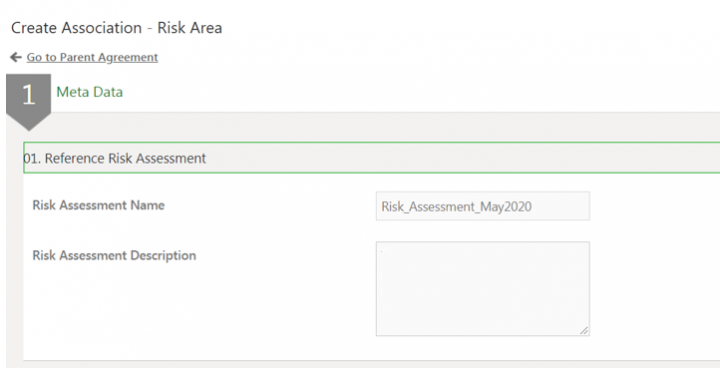

Reference Risk Assessment

This section contains the attributes:

- Risk Assessment Name: This field is populated automatically based on the information entered when creating the risk assessment.

- Risk Assessment Description: This field is populated automatically based on the information entered when creating the risk assessment.

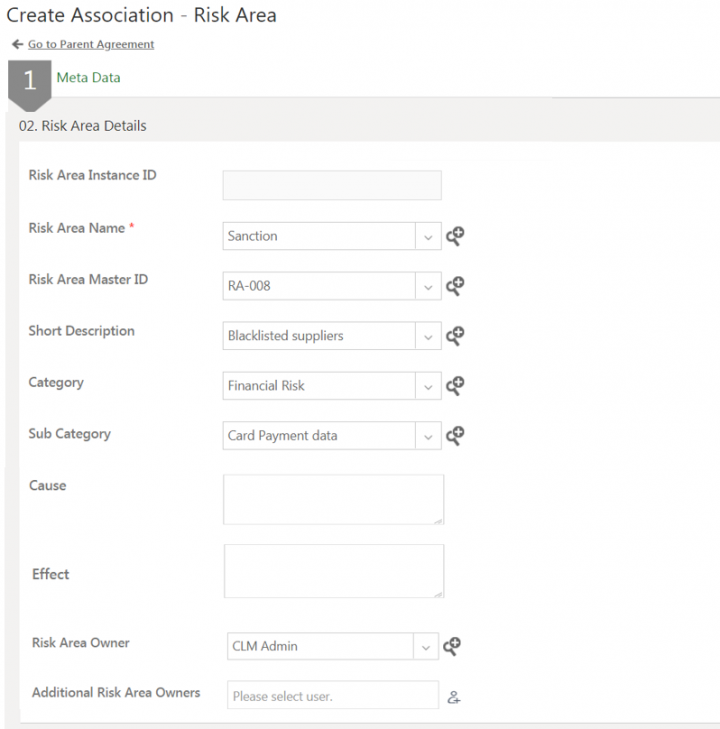

Risk Area Details

This section contains the attributes:

- Risk Area Instance ID: This is generated automatically after the risk area is created.

- Risk Area Name: Select the risk area name from the drop-down list. This populates the information for the following attributes from the masterdata.

- Risk Area Master ID

- Short Description

- Category

- Sub Category

- Risk Area Owner

- Origin: Enter the description that contains information about the probable source of risk area.

- Effect: Enter the description about the probable effects of the risks foreseen based on the risk assessment created.

- Additional Risk Area Owners: If risk area owner is not available in master, then user can add additional risk area owners.

Risk Area owners are Subject Matter Experts who can look into risk area end to end for validity of risk, planning risk remediation, monitoring the progress and performance of risk remediation actions

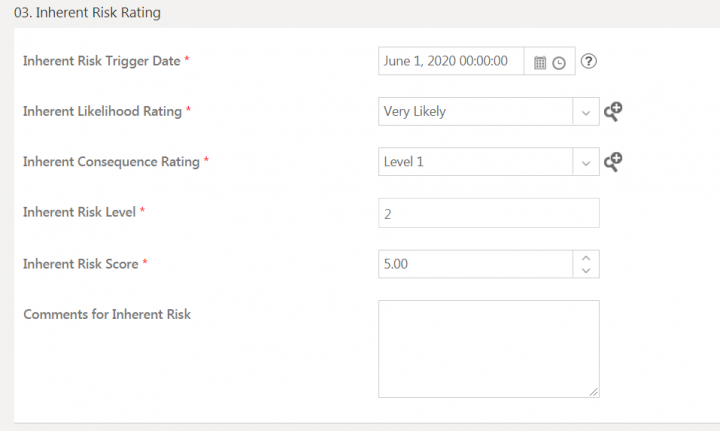

Inherent Risk Rating

Inherent risk rating is the risk rating applicable to the risk when it was determined for the first time.

This section contains the attributes:

- Inherent Risk Trigger Date: The date and time on which the inherent risk record is created.

- Inherent Likelihood Rating: The probability of occurrence of risk.

- Inherent Consequence Rating: The impact or consequence of risk occurrence.

- Inherent Risk Level:Qualitative scoring based on likelihood of risk occurrence and consequence if risk occurred.

- Inherent Risk score:Quantitative scoring based on likelihood of risk occurrence and consequence if risk occurred.

- Comments: This includes any additional information that you might want to provide regarding the risk assessment created.

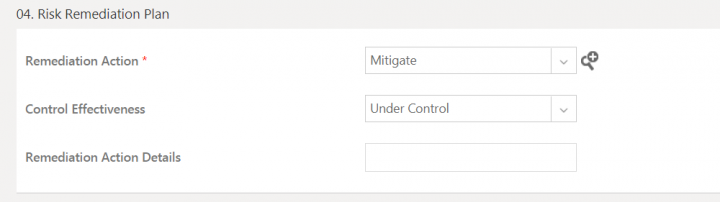

Risk Remediation Plan

This section includes the informaton related to the remediation strategies and actions that can be taken to mitigate the risk areas.

This section contains the attributes:

- Remediation Action: Enter the remediation action that is planned to be taken to minimize the probable risks.

- Control Effectiveness: Select the level from the drop-down list that defines the level of effectiveness of measures that will be applied to minimize the risks.

- Remediation Action Details: Enter the remediation action details that describe the remediation actions that will be taken to minimize the risk.

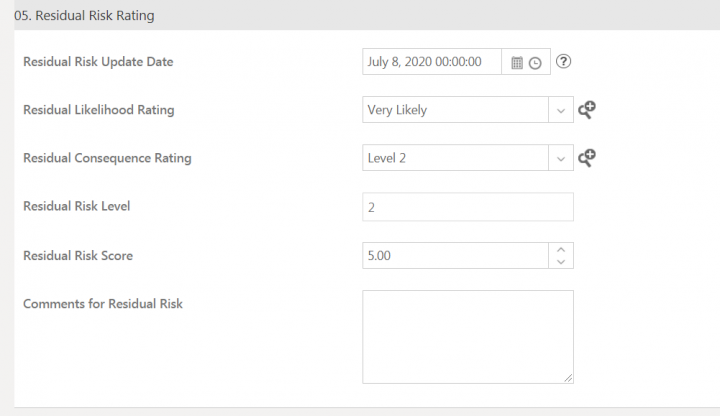

Residual Risk Rating

This section includes the information related to the residual risk left after the remediation actions are taken.

This section contains the attributes:

- Residual Risk Update Date: The date on which the residual risk record is updated.

- Residual Likelihood Rating: This indicates the likelihood of occurrence of the remaining risk.

- Residual Consequence Rating: This indicates impact of occurrence of the remaining risks happening after the mitigations actions are implemented.

- Residual Risk Level: Qualitative scoring based on likelihood and consequence if residual risk occurred.

- Residual Risk Score: Quantitative scoring based on likelihood and consequence if residual risk occurred.

- Comments for Residual Risk: This includes any additional information that you might want to provide regarding the risk area.

5. Click Create. The Risk Area is created in Assessment state.

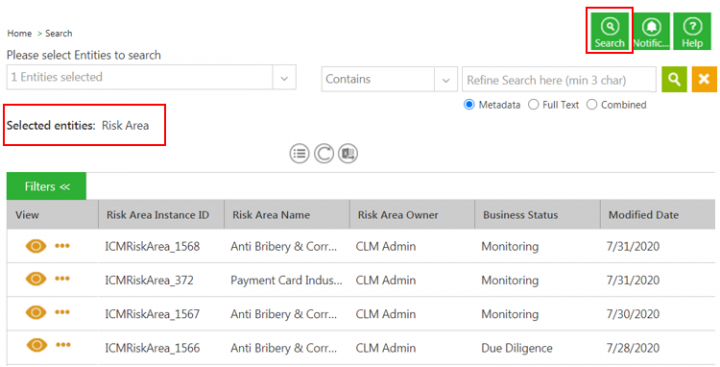

Searching Risk Area records

Risk Area records can be searched from:

- Advanced Search page

- Global Search

- Associations index page

To search risk area from Advanced Search page:

1. Click Search tile on the ICI UI. The Advanced Search page opens.

2. Select Risk Area in the Please select Entities to search field.

3. Click the search icon. All available Risk Area records are displayed.

To search risk area using Global Search

Enter the relevant search criteria in the Enter search here…search bar on the ICI UI. For example, Risk Area. All available Risk Area records are displayed in a drop down.

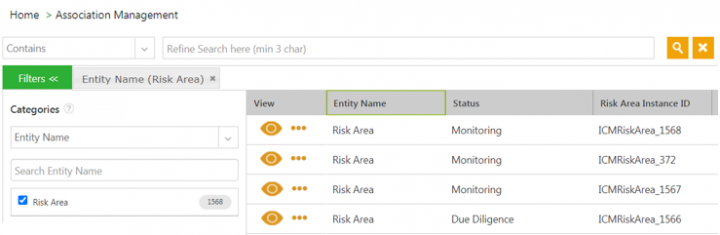

To search risk area from association index page:

1. Click Associations Management > Associations on the Home page. The Associations index page opens.

2. Filter the records for Risk Area entity using Categories facet search. All available Risk Area records are displayed.

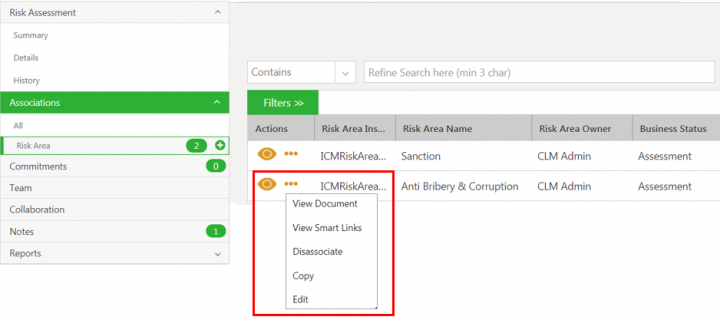

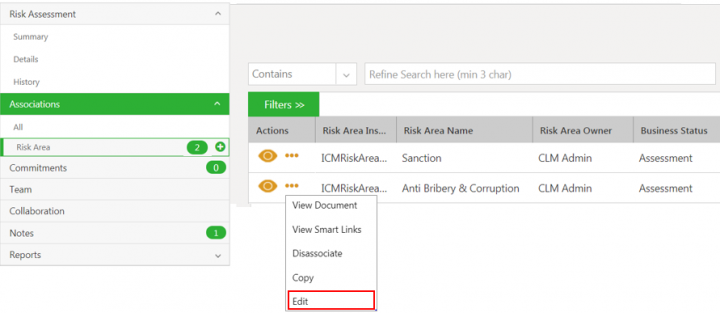

Working of existing ICI actions for Risk Area

Risk area owner can take existing ICI actions for associations on risk area.

- View Document: Opens the preview of the risk area if available, in the Document Viewer window.

- View Smart Link: Opens the smart links if available, in a Smart Links window.

- Dissociate: Displays the error message as Oops something went wrong, please try again. : You do not have necessary access privileges for this functionality,

- Copy: Copies risk area instance.

- Edit: Opens the Edit Associated Document - Risk Area page to modify the details of the risk area instance.

Taking actions on the Risk Area

The Risk owner can be added to the risk area through configured rules. Risk owner can then take certain actions from the risk area Details page.

The actions can be:

- Initiate Due Diligence - action taken to capture more information related to the risk and validate the identified risk area.

- Remediate - action taken to mitigate the valid risk area.

- Deactivate - action taken for risk area identified as invalid. Users cannot take further actions once the risk area is deactivated.

- Monitor - action taken to track the performance based on remediation actions until risks are completely mitigated

Users can repeat the workflow Due Diligence – Remediate – Monitor until the risk is completely mitigated.

Users can also automate the workflows to initiate due diligence, remediate and monitor risk areas by configuring rules.

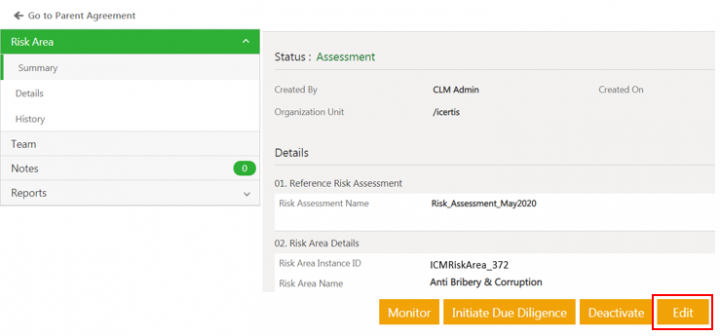

Editing Risk Area

1. Click Risk Management > Risk Assessments on the Home page. The list of all available risk assessments opens.

2. Click View Record icon next to the Risk Assessment you want to opens. The Risk Assessment Details page opens.

3. Click Risk Area tab in the left navigation. The risk area grid opens.

4. Click View Record icon next to the risk area you want to open. The risk area Details page opens.

5. Click Edit. The Edit Associated Document for Risk Area page opens.

6. Make the required changes and click Update. The Risk Area is updated and the Risk Area Details page opens again.

Users can edit the risk area from risk area details page as well.

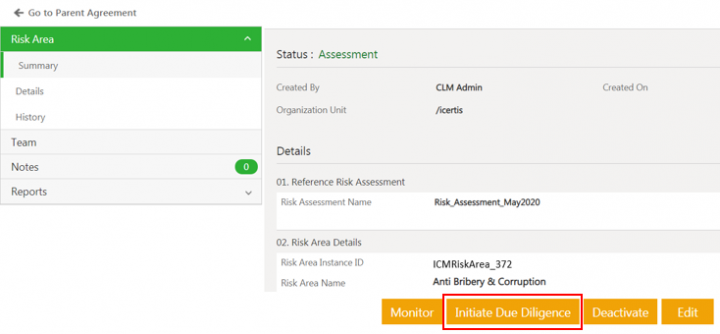

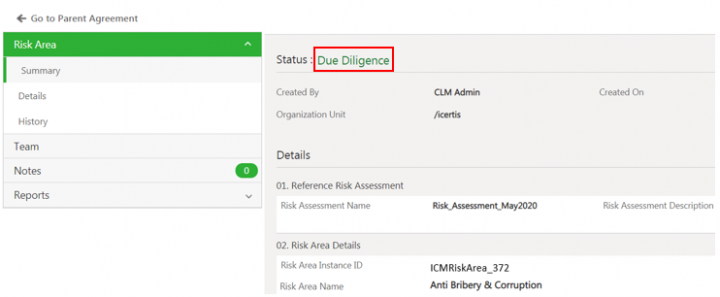

Initiating Due Diligence

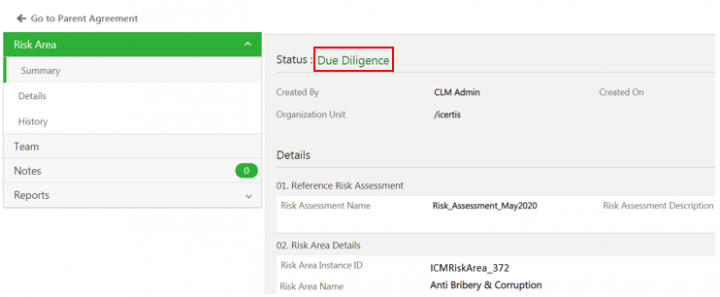

Click Initiate Due Diligence. The Risk Area Details page opens again.

The status of the risk area changes to Due Diligence.

Remediating the risk area

Click Remediate on the risk area Details page. The Risk Area Details page opens again.

The risk area Details page opens again and the status of the risk area changes to Remediation..

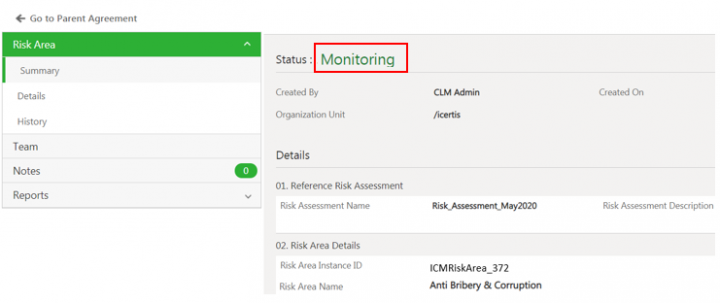

Monitoring the risk area

Users can monitor the risk areas based on the remediation actions taken to check whether the risks are reduced.

To monitor a risk area:

Click Monitor on the risk area Details page. The risk area Details page opens again and the status of the risk area changes to Monitoring.

The status of the risk area changes to Monitoring.

Iterating workflow for risk area

Users can repeat the actions taken on the risk areas until the risks are completely mitigated.

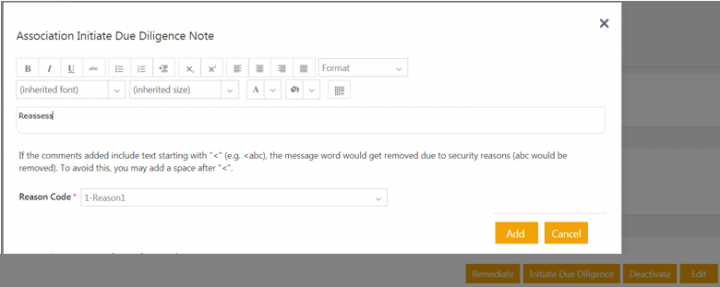

1.Click Initiate Due Diligence or Remediate on the risk area Details page for the risk area in the Monitoring state. For example, select Initiate Due Diligence. The Association Initiate Due Diligence note window opens to add a note.

2.Add a note text and select a Reason code.

3. Click Add. The status of the risk area changes back to Due Diligence.

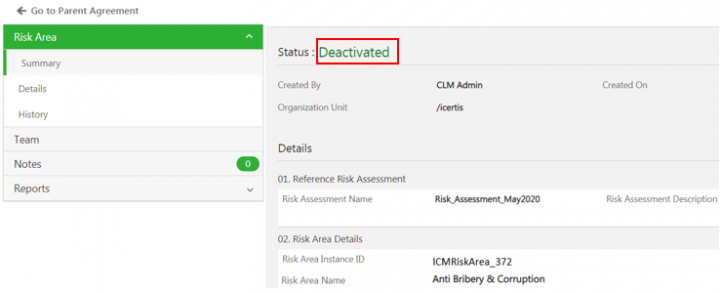

Deactivating the risk area

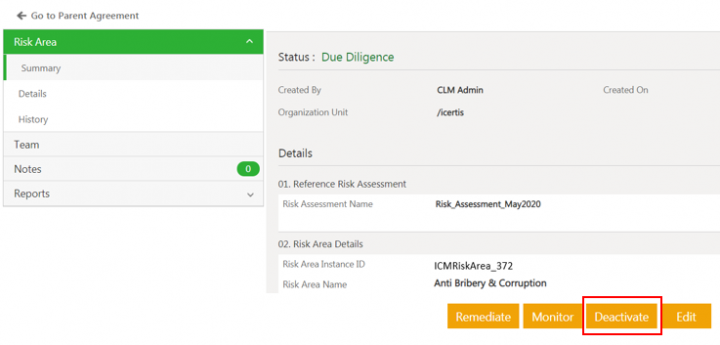

Risk owners can deactivate the invalid risk area. Once deactivated, no further actions are allowed on the risk area.

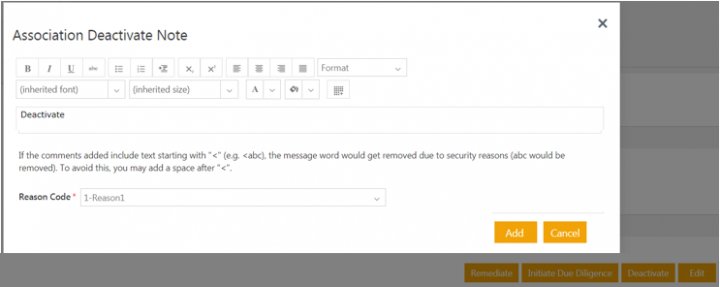

1. Click Deactivate on the risk area Details page. The Association Deactivate note window opens to add a note.

2. Add a note text and select a Reason code.

3. Click Add. The status of the risk area changes to Deactivated.

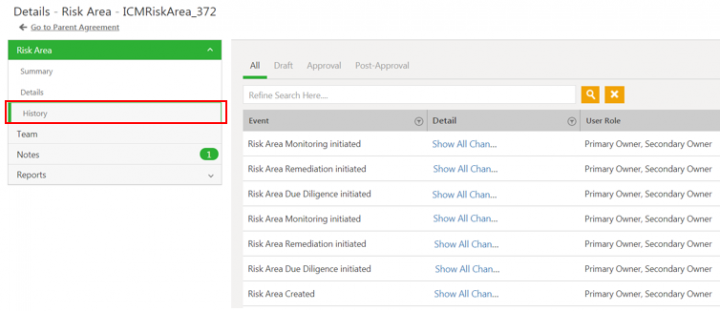

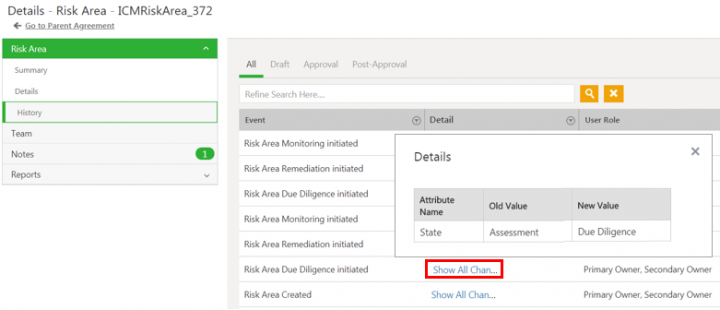

Auditing Risk Area

Changes made to the Risk Area record during various ICI risk management workflows are captured and can be viewed under History tab. For example, changes in ICIRiskArea_372 throughout its lifecycle are captured.

Click Show All Changes to view the details of the particular event of the risk area instance.

Moving Risk Area workflow automatically

The users can manage the Risk Assessment and Risk Area action workflows using the script attribute Target ICM Status. Users can set the value in Target ICM Status to specific status and move records to that particular state during the risk management workflow. For example, risk area record can be moved from the Draft state to either Due Diligence, Remediation or Monitoring state using attribute Target ICM status .

Risk assessment and risk area records can be uploaded in ICI directly in specific status by setting the state value in the Target ICM Status attribute using ICI’s Legacy Upload functionality. The business status would then be set accordingly.

For example, when users want to upload large number of historical risk assessment records using Legacy Upload, they can directly upload in the Approved state by setting it in the Target ICM Status attribute and the business state would be set as Assessment Complete.

Refer the ICI Risk Management Configuration Guide for details on Managing Risk Workflows using attribute Target ICM Status.

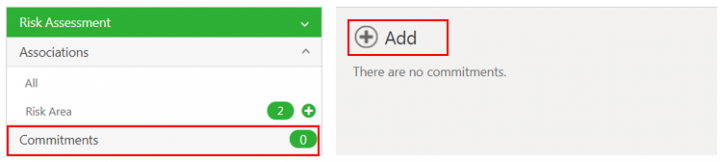

Creating and managing tasks for Risk workflow

Users can create remediation tasks for managing risks using commitments, obligations or any third party system. ICI Risk Management app currently supports managing Risk Assessment and Risk Area using ICI Commitment functionality.

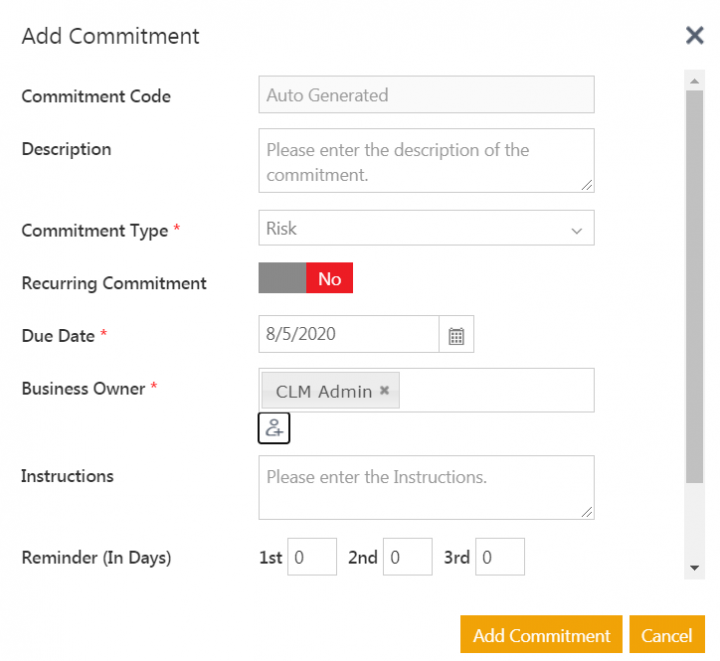

To create a task using commitment:

1. Click the Risk Management > Risk Assessment on the Home page. The saved search result page opens with all Risk Assessment records.

2. Click the View Record icon next to the Risk Assessment record you want to open. For example, Risk_Assessment_May2020. The Risk Assessment Details page opens.

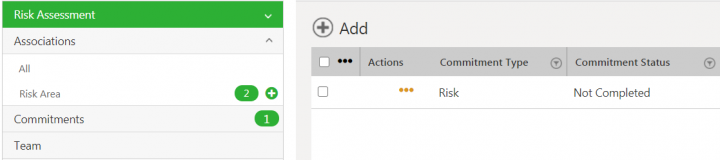

3. Click the Commitments tab in the left navigation. The existing commitments are displayed if any.

4. Click Add Commitment action icon. The Add Commitment window opens

5. Enter the details for the commitment.

6. Click Add Commitment. The commitment is created and added to risk assessment.

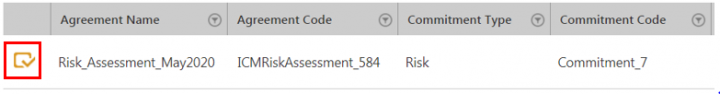

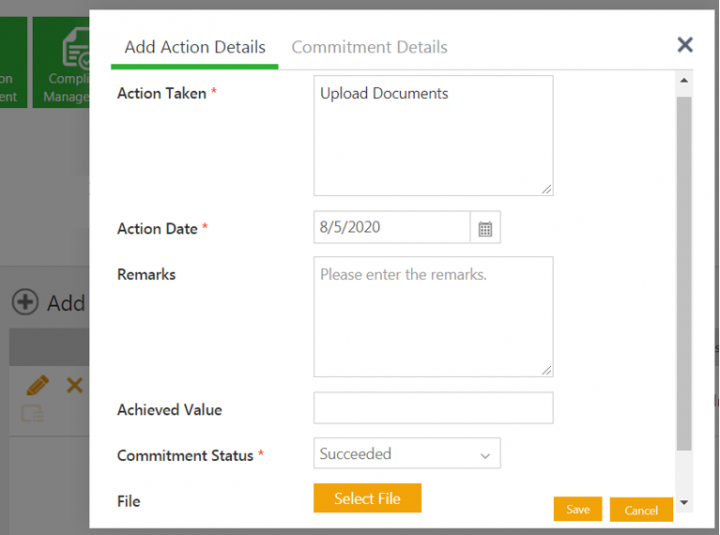

To view and take action on the commitment tasks:

1. Click the icon Take action on commitment. The Add Action window opens.

2. Add the action details.

3. Click Save. The Commitment status is updated according to the action taken.

Refer to the Compliance Management for more details on working with commitments.

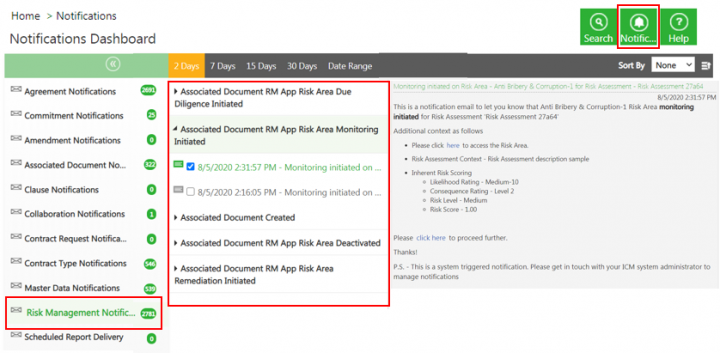

Accessing the Risk Area actions Notifications

The ICI Risk Management app sends the notifications when certain actions are taken on the Risk Area. These notifications are seeded.

The notifications are sent when events occurs:

- Risk area is created

- Risk area due diligence is initiated

- Risk area remediation is initiated

- Risk area monitoring is initiated

- Risk area is deactivated

The recipients can access the notifications from Notification Dashboard:

- Click Notifications tab on the Home page. The Notifications Dashboard opens.

- Click Risk Management Notifications. The list of notification events opens.

- Expand the notification event. The notifications belonging to the selected event are displayed.

- Select the Notification you want to view. The selected Notification opens in the right pane.

Related Topics: Agreement Management | Biz Apps Release Notes |